UKG Timecard Rounding and Rounding Rules are hot topics for many of our clients these days. If your Human Resources (HR) or UKG Administrators are unclear about your company’s Timecard Rounding policy, there’s a good chance your supervisors and employees are equally confused. This confusion can end up costing your business big bucks.

In our first post on timecard Rounding, we discussed UKG Dimensions and how that platform treats Rounding overall without applying Grace or Break Rounding. So now, let’s explore how Grace impacts Rounding.

Inconsistent or unclear Rounding Rules can cause frustration within an organization. Employees may assume the worst and believe they’ve been treated unfairly on their hours. Explaining the Rounding process and putting together examples after the fact to show your rationale to others can be exhaustive and unproductive. Understanding and training your team on Rounding Rules will save time, morale, and money.

Inaccurate Rounding

Inaccurate Timecard Rounding can lead to several consequences, including:

-

Pay Loss: Rounding errors can result in underpaying or overpaying employees. If timecards are consistently rounded down, employees may lose out on pay, which can be demotivating and create resentment.

-

Higher Risk: Inaccurate Timecard Rounding can lead to noncompliance with labor laws, resulting in fines and legal action.

-

Low Employee Trust: Employees who feel they are not being paid accurately may distrust their employer, which can put a dent in morale and productivity. Employees may also be less likely to report time accurately if they think the timecard system is flawed or unfair.

-

More Admin Time: If Timecard Rounding is not precise, HR and payroll personnel may have to devote more time to resolving differences between the reported and actual hours worked, addressing employees' payment concerns, and possibly re-evaluating payment for a substantial number of workers. This additional time translates to additional costs.

Grace Rounding

HR and UKG Admins often have two major obstacles to consider when establishing Rounding rules. First, what rule is fair for the employee versus what is fair for the company. Another concern is making the final numbers work for the company’s financial engine.

For example, suppose a company establishes a basic ¼ hour Rounding Rule. In that case, the time going into the company’s financial application includes easy-to-work-with 15-minute chunks of time—very clean for accounting.

Punch Rounding

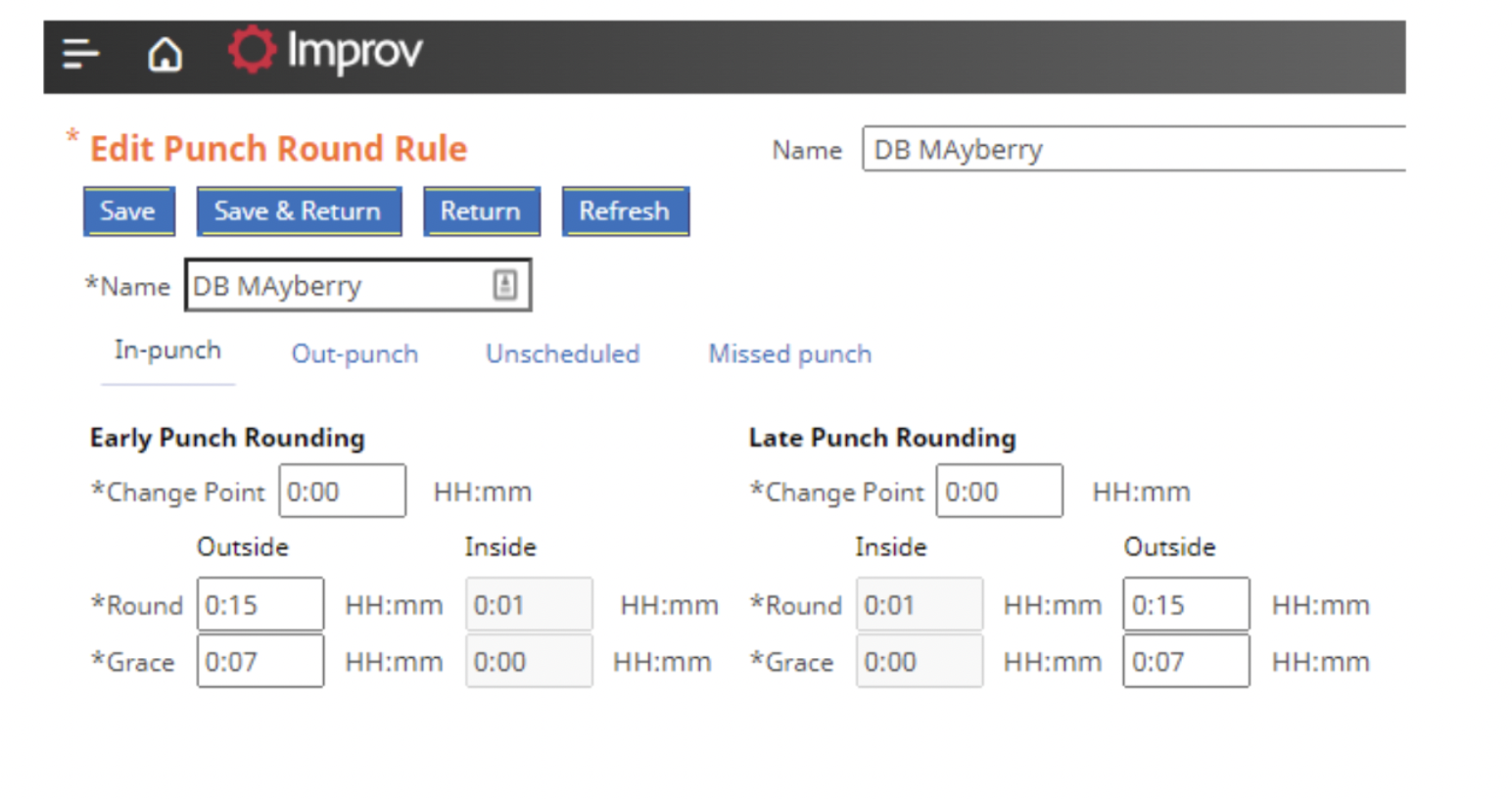

In UKG Dimensions, multiple configuration settings exist for Rounding. In the following example of Punch Rounding, the In-Punch setting indicates 15-minute Rounding with a 7-minute grace period.

This means the quarter of an hour will be split in half, and the punch may be rounded forward to the next quarter-hour or backward to the previous quarter-hour, depending on which side of the 7 minutes the punch is applied.

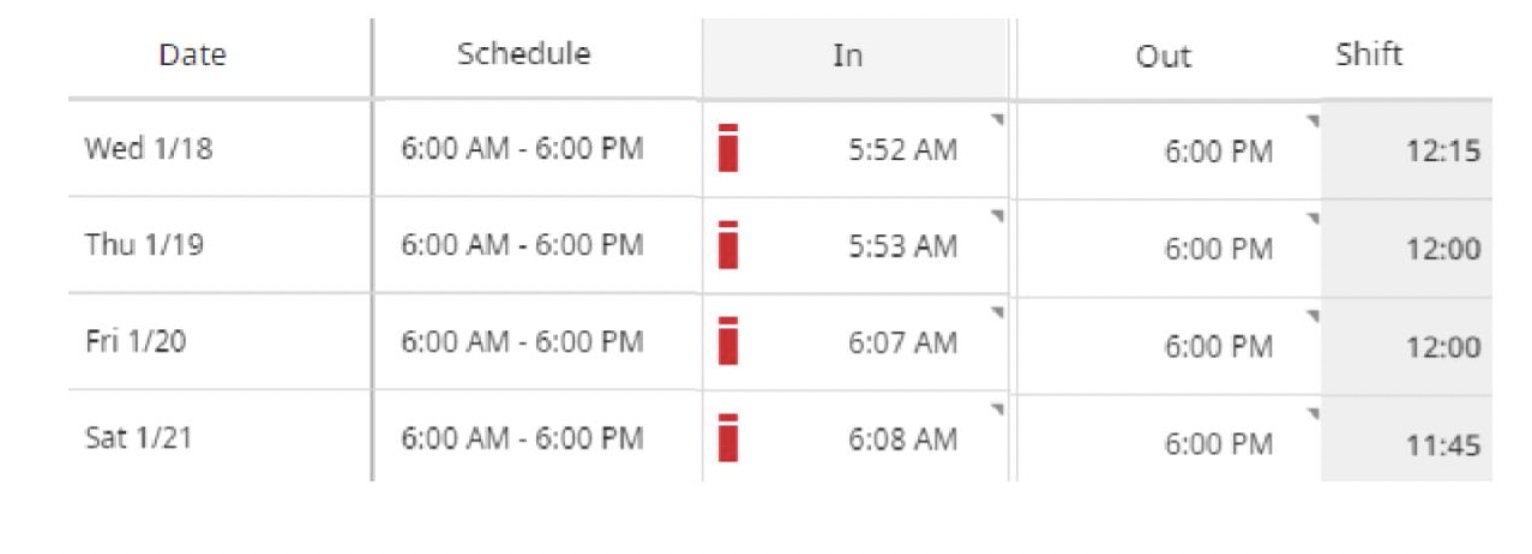

Let’s use the example of Opie Taylor’s timecard.

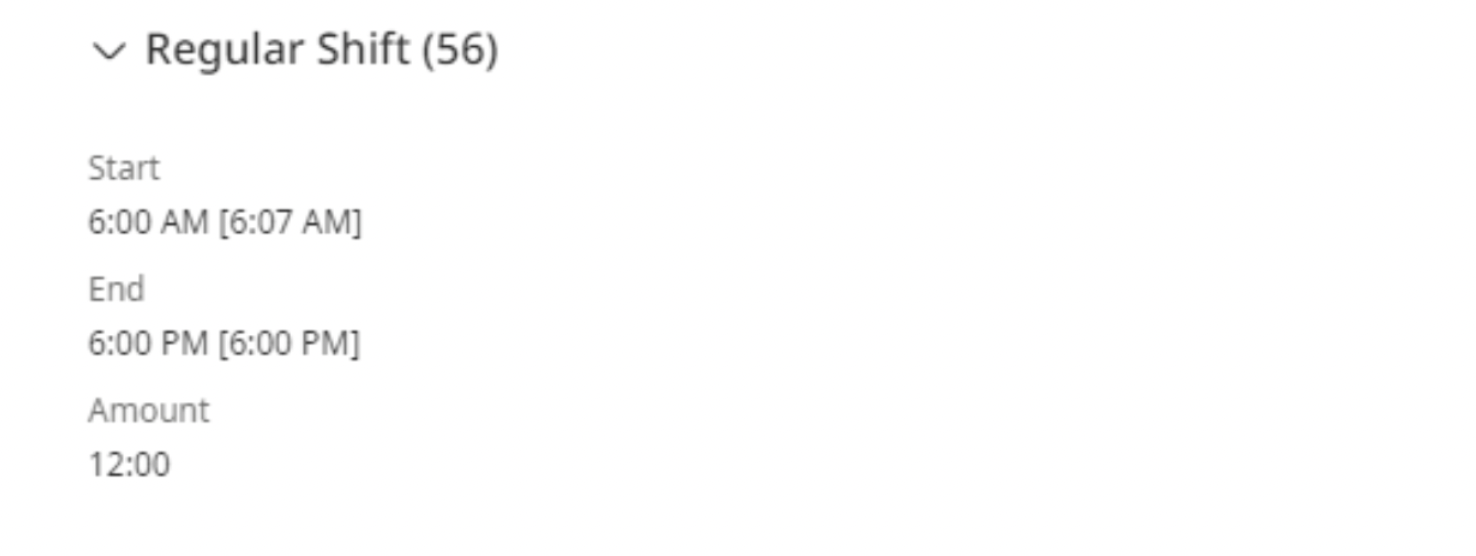

By using the Analyze action, the details of the Rounding and grace can be observed.

The date 1/18 has an actual In-Punch of 5:52 with a total shift time is 12:15. This punch was rounded back to 05:45 AM because this punch was applied 8 minutes before the top of the hour. Had the punch occurred one minute later, it would have rounded forward to the top of the hour.

The date 1/19 has an actual In-Punch of 5:55 with a total shift time is 12:00. This punch was rounded forward to 06:00 AM.

The date 1/20 has an actual In-Punch of 6:07 with a total shift time is 12:00. This punch was rounded backward to 06:00 AM.

The date 1/20 has an actual In-Punch of 6:07 with a total shift time is 12:00. This punch was rounded backward to 06:00 AM.

The date 1/21 has an actual In-Punch of 6:08 with a total shift time is 11:45. This punch was rounded forward to 06:15 AM.

Please keep in mind there are several options for Timecard Rounding. The important thing to understand and practice is your company’s Rounding policy.

Because inaccurate Timecard Rounding can have significant consequences for employees and employers, it’s essential to reach out to a qualified UKG consultant for help sooner rather than later. Improv ACs are experienced, creative, and responsive. We can help you implement and regularly review accurate Rounding practices to ensure compliance.

Need Faster, Better UKG Dimensions™ Support?

Improv can help you with your UKG Dimensions™ migration and ongoing optimization support for WFC.

Please don’t wait. Connect with us today.

Getting the ongoing Dimensions support you need is easier than you think! Click below to learn more about how you can work with Improv—a trusted UKG-certified partner.

.png)

.png)

.png)

Comments